Why Are Remittance Startups Ignoring the Countries That Need Them Most?

Tech In Africa | Grace Ashiru - Nov 19, 2025

Featured entitiesThe most prominent entities mentioned in the article. Tap each entity to learn more.

AI OverviewThe most relavant information from the article.

- Sub-Saharan Africa received $56 billion in remittances in 2024.

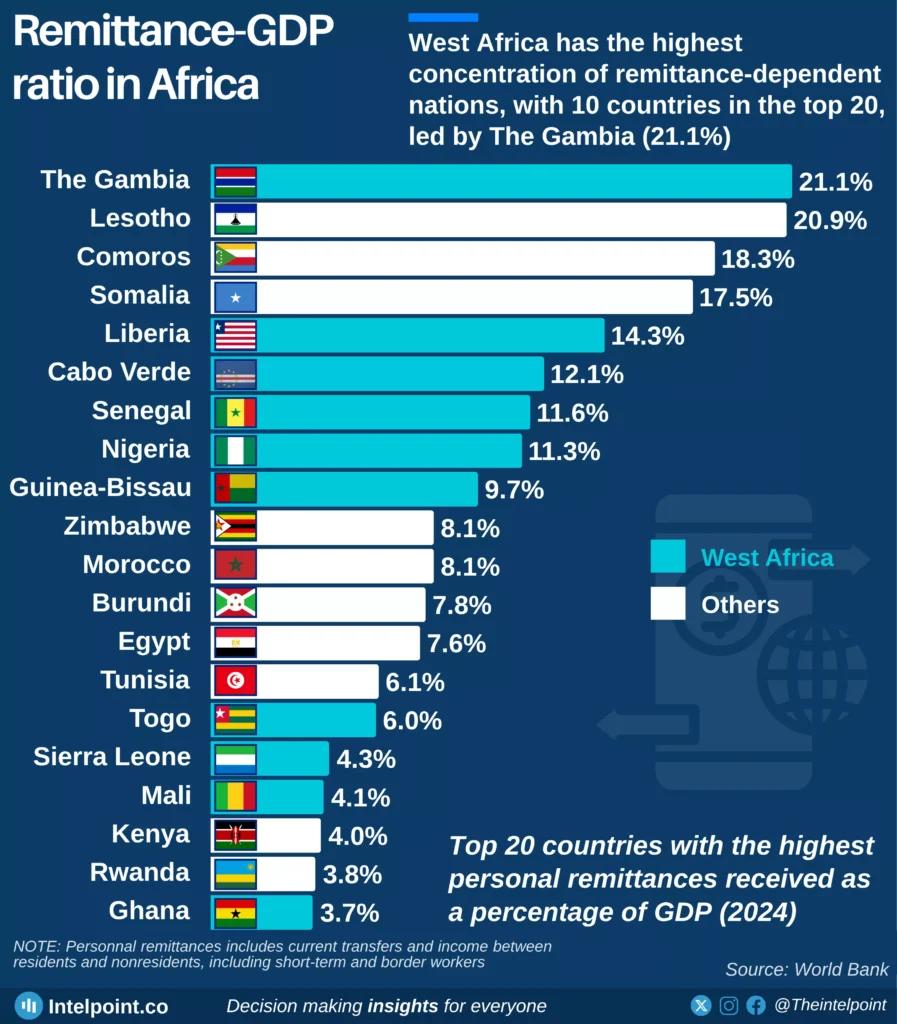

- The Gambia relies on remittances for over 21% of its GDP, while Lesotho and Comoros also have high remittance-to-GDP ratios.

- Well-funded startups like LemFi, NALA, Flutterwave, and Chipper Cash focus on the Nigeria-Kenya-South Africa corridor, neglecting smaller markets.

CommentaryExperimental. Chat GPT's thoughts on the subject.

The remittance market in Sub-Saharan Africa presents a paradox where high dependency on remittances does not translate into startup opportunities. This raises questions about market dynamics and the potential for innovative solutions tailored to smaller markets. A focus on strategic partnerships and embedded financial services could unlock significant value in these underserved regions.

SummaryA summary of the article.

Also readRecommended reading related to this content.

Newsletter

Sign up for the Newsletter

Discussion

Need startup advice?

Leverage the Hadu community to get answers and advice for your most pressing questions about Africa Tech.