Capitec VRP lets South Africans make recurring payments directly from bank

TechCabal | Sakhile Dube - Dec 04, 2025

Featured entitiesThe most prominent entities mentioned in the article. Tap each entity to learn more.

AI OverviewThe most relavant information from the article.

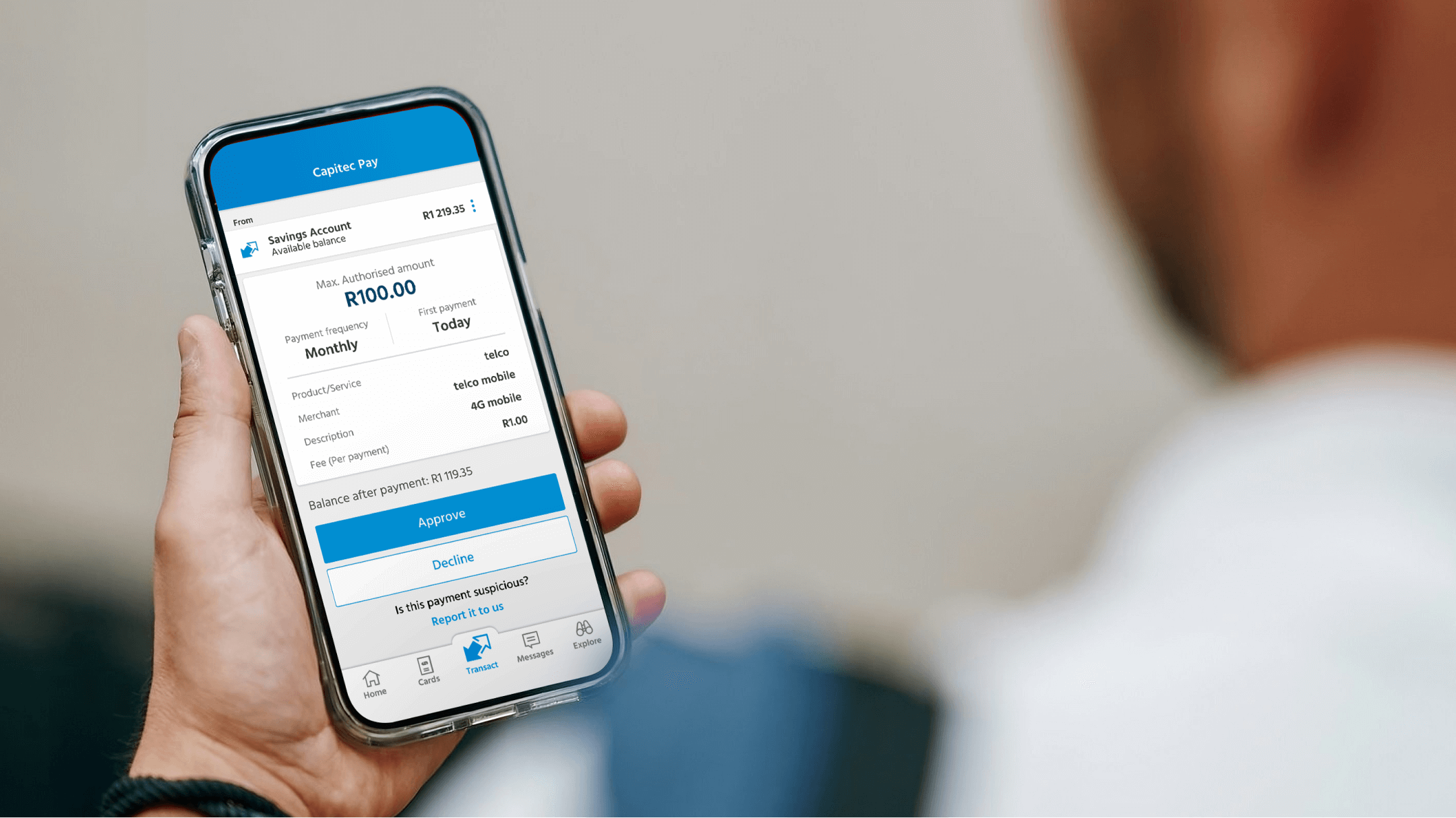

- Stitch partners with Capitec Bank to automate recurring payments for services.

- Capitec Pay VRP allows customers to set a maximum spending limit for automated payments.

- The service reduces reliance on cash-on-delivery models.

CommentaryExperimental. Chat GPT's thoughts on the subject.

The partnership between Stitch and Capitec Bank represents a significant advancement in the South African fintech landscape, potentially transforming how consumers manage recurring payments. This innovation not only enhances user experience but also positions Capitec as a leader in adopting new payment technologies. Further discussions could explore the implications of VRPs on consumer behavior and the competitive landscape among banks.

SummaryA summary of the article.

Also readRecommended reading related to this content.

Newsletter

Sign up for the Newsletter

Discussion

Have a question related to Africa Tech?

Leverage the Hadu community to get answers and advice for your most pressing questions about Africa Tech.