Inside the rise of global accounts among everyday Nigerians

Bendada.com | Andrew - May 13, 2025

Featured entitiesThe most prominent entities mentioned in the article. Tap each entity to learn more.

AI-generated highlightsThe most relavant information from the article.

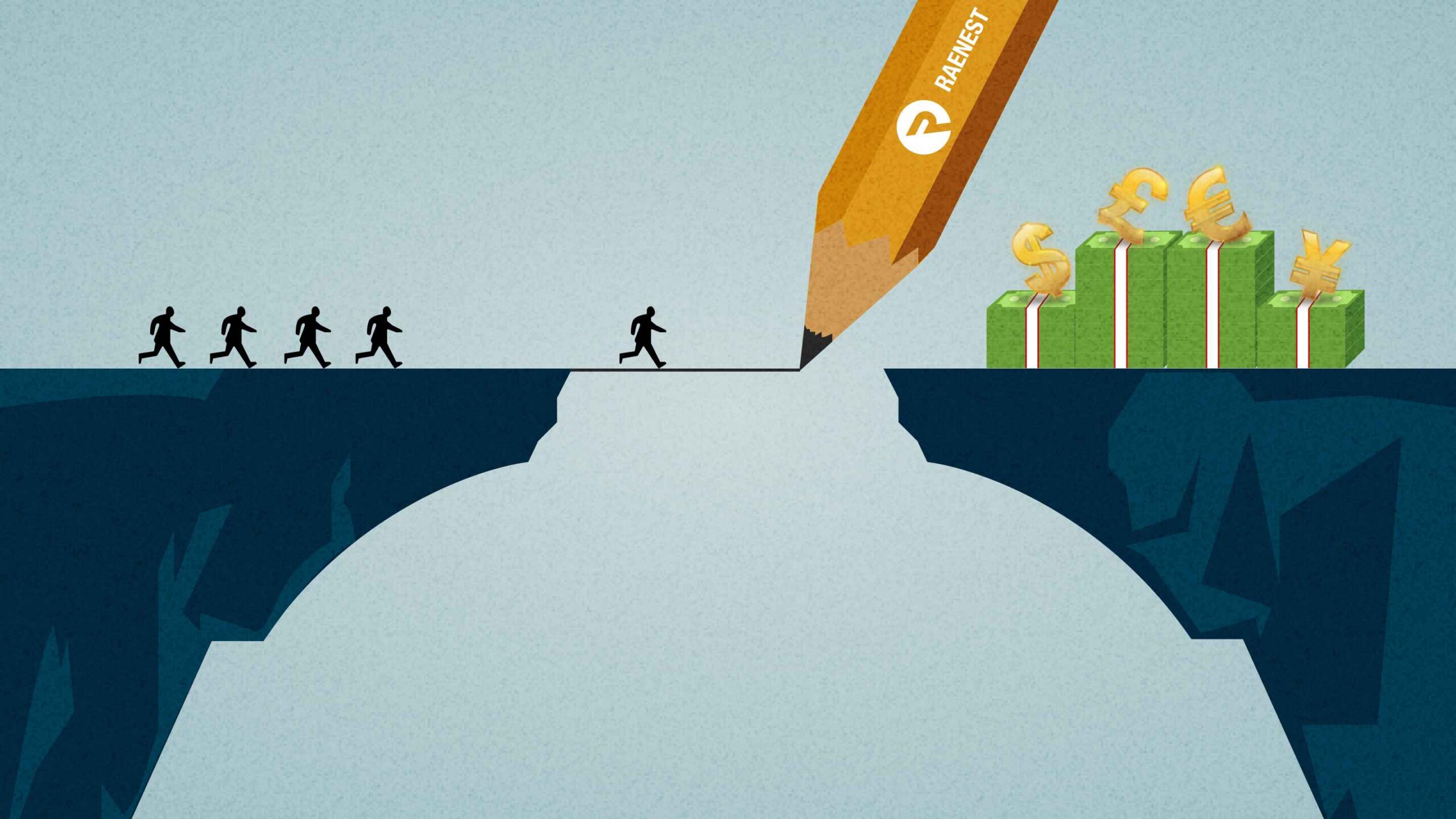

- Victor Olulewa faced challenges in accessing payments from a foreign client due to Nigeria's currency crisis.

- Many Nigerians are turning to dollar, Pound, and Euro-denominated accounts to protect their wealth from inflation.

- Joseph Gbadamosi found it difficult to get paid by international clients until he discovered Geegpay, a fintech platform for cross-border payments.

CommentaryExperimental. Chat GPT's thoughts on the subject.

The reliance on foreign currency accounts and fintech solutions highlights the urgent need for regulatory reforms in Nigeria's financial system. While these tools provide immediate relief to freelancers and small business owners, the long-term implications for monetary policy and economic stability must be carefully considered. Policymakers should prioritize creating a stable environment that supports both local and international transactions.

SummaryA summary of the article.

Also readRecommended reading related to this content.

Newsletter

Sign up for the Newsletter

Discussion

Need startup advice?

Leverage the Hadu community to get answers and advice for your most pressing questions about Africa Tech.